The short answer is No. The more complicated answer is mostly no over 99% of the time. It’s very rare. It happens but is very rare.

I’ll explain why it’s rare for insurance to cover a heavy upper lid surgery or any cosmetic procedures and then I’ll explain why my practice has chosen not to deal with the constraints (there’s a more descriptive word I’d rather use but it’s considered unprofessional) the medical insurance industry puts on my patients and my ability to care for them.

Insurance Wants to Know Whether You Can Still See?

Your insurance provider doesn’t care if you look tired or if you must physically lift a heavy upper lid with your finger just to fully see your computer screen.

If you can still see, for the most part, you’ll be denied.

Insurance companies do not cover blepharoplasty for cosmetic reasons. They may cover upper eyelid surgery (upper blepharoplasty) when excess skin or drooping eyelids cause severe functional problems, like obstruction of the upper visual field, substantial trouble with daily activities, or documented vision problems confirmed by visual field testing and photos.

Lower eyelid surgery is almost always considered cosmetic and is rarely covered by medical insurance.

Why Insurance Coverage Depends on Medical Necessity

Blepharoplasty sits at the intersection of cosmetic surgery and functional procedures. Insurance carriers don’t ask whether you look tired. They ask whether your eyelids interfere with vision, daily life, or eye health.

That distinction drives everything. And it’s that distinction the insurance companies use to deny 99.9% of upper eyelid surgery requests.

Because “blepharoplasty” is one word that covers two very different stories:

1. Cosmetic eyelid surgery

This is the “I want a more youthful appearance” lane. Insurance carriers always decline because lower eyelids (lower blepharoplasty) are under-eye bags and lower lid contour. That’s considered cosmetic purposes, even when it bothers you every day and you’re never going to convince your insurance company otherwise.

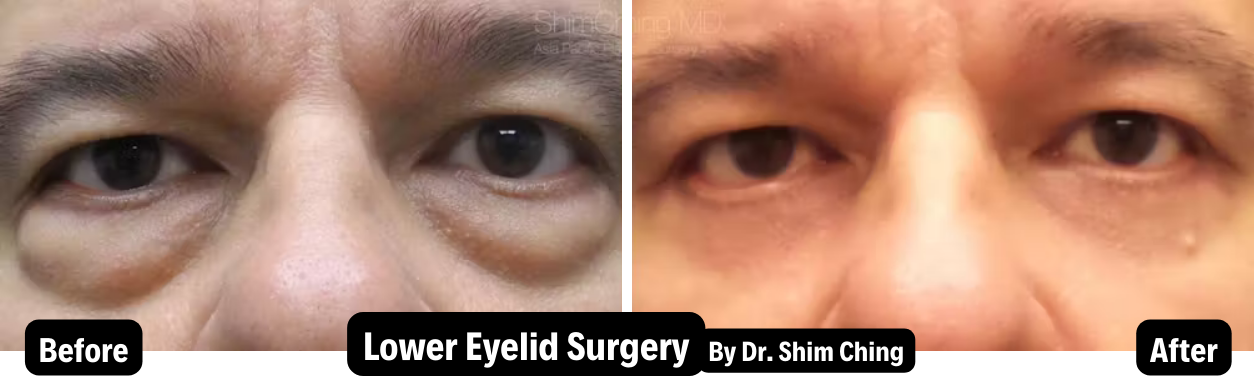

Here’s a patient of mine (photos used with permission, of course) who had a lower blepharoplasty:

He could see fine beforehand. But look how much more alert and younger he appears in the photo after a few months of healing from the lower eyelid procedure.

That’s 100% cosmetic. He loved his results and he looks great.

2. Functional blepharoplasty (medical necessity)

This is the “my upper lids block my field of vision” lane. That’s where insurance coverage becomes possible, especially for upper eyelids. But you must prove that your field of vision is severely limited to an extent that it disrupts your life or endangers you.

- Can you still drive?

- Are you able to walk across the street, albeit slowly, without getting run over?

- Is your vision so limited you could be legally classified as having limited vision?

My patient above is thrilled with her results. She looks younger, more relaxed, and refreshed. While her field of view is certainly better after the procedure, we could have never made a case for insurance coverage.

Do you see where this is going? The system and their harsh requirements are stacked against you.

What Insurance Companies Claim They Are Looking For From You

Insurers tend to ask the same question in different ways:

“Prove this is a medical issue, not cosmetic enhancement.”

Most insurance plans want a combination of:

Symptoms that affect day-to-day life

Common examples that show up in policies:

- Difficulty reading

- Trouble driving, especially at night

- Eye strain, forehead strain, or compensating by raising the brows

- A chin-up head posture to see “under” the lids

Proper documentation

This is where approvals are won or lost.

Many insurance carriers want:

- Physician notes and medical records documenting the functional problems

- Photographic evidence (straight-on, eye level photos showing lid position relative to the pupil)

- Visual field testing showing loss of the superior field that improves when the eyelid/brow is lifted (often taped)

Objective measurements (yes, they get picky)

Some policies reference measurements like:

- MRD1 (margin reflex distance) around 2 mm or less, and

- Documented superior visual field loss (examples include thresholds like degrees or percentage loss).

Not every plan lists the same numbers, but the theme stays the same: functional impairment plus plenty of proof.

Right now, you may be thinking that you meet all those criteria and you may, but you’ll still be denied.

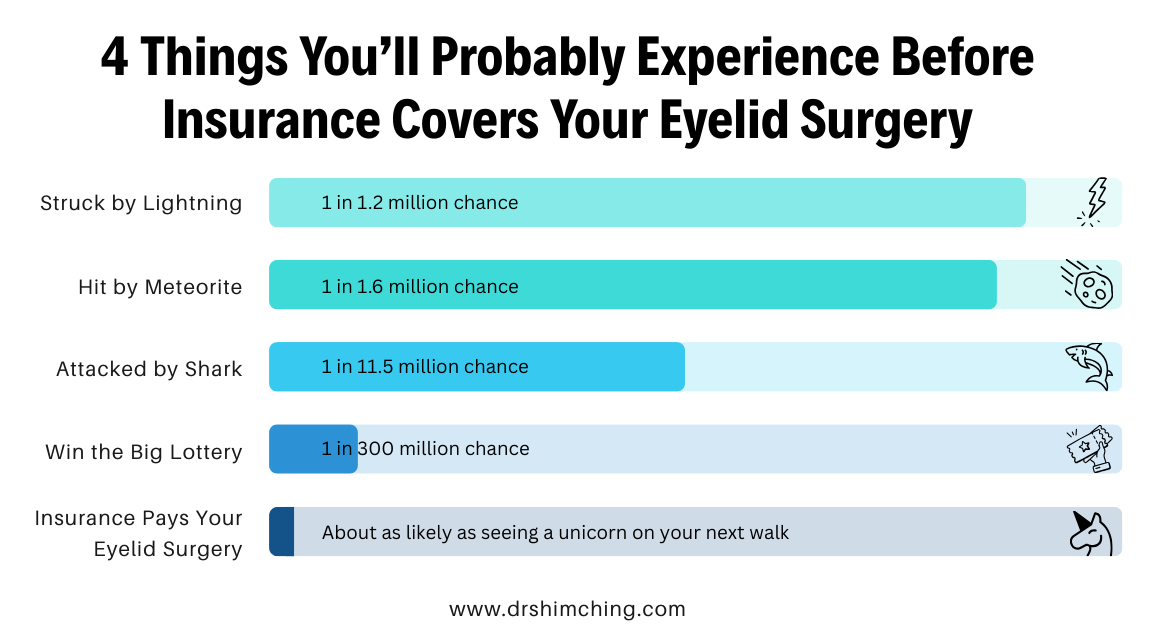

As I’m not one to quit or to tell someone to give up on something that matters to them, I’ll walk you through the process but please know, your chances of successfully getting an insurance company to cover your upper eyelid lift are less than the chance of winning a major lottery.

Conditions That May Qualify for Insurance Coverage (But Rarely Do)

Insurance providers are looking for documented functional problems, at least that’s what they’ll tell you when you begin the process. Here’s what they’re going to ask you initially:

- Obstruction of the upper visual field

- Difficulty reading or driving

- Eye strain or forehead fatigue

- Needing to raise the eyebrows or tilt the head to see clearly

- Sagging skin resting too close to the lashes

- Visual fatigue affecting daily activities

After you passionately inform your health insurance agent that you do experience all of the above, you’ll be guided to the next step which is a series of requirements that the industry uses as a filter because they know most people give up at this point.

I’m not going to walk you through those steps. It’s a waste of time and effort and insurance companies know this. If you’re determined and committed to seeing this through, I can give you some advice to speed up the process.

The insider knowledge “first step” that saves people weeks

Track down a surgeon who accepts your insurance. Call the office and ask this:

“Do you evaluate patients for functional blepharoplasty and handle insurance pre-authorization?”

The surgeon’s office should know the insurance requirements, and will guide you through the following:

- what documentation your insurance provider wants

- whether you need an eye doctor exam (you will)

- whether brow ptosis (drooping brow) or ptosis repair belongs in the plan

Why My Office Doesn’t Work with Insurance Companies on Blepharoplasty Surgery

Young, fresh, hungry surgeons are more likely to accept insurance for this procedure. They need the experience and the full scope of the horror that is the insurance industry hasn’t broken them yet. In a sense, I miss those days.

Over my career I’ve done thousands of eyelid procedures. I know what it takes to make sure the patient is happy with the results. Insurance puts too many limitations on what I can do for my own patient. They limit the time spent in the OR. They limit what exact techniques I can use through their payment reimbursements. They control both anesthesia and the recovery process. And they determine how nursing care is provided and paid for afterward.

Each patient is different and I will not be dictated to by a massive insurance company in Minnesota when it comes to patient care.

And then there’s the time-suck. The classic wasting of one’s time that the insurance behemoths have turned into a strategic artform. When you call to deal with your insurance carrier, how long do you wait on the phone? How long does it take to go over everything with a real person? Doctors and office staff receive no special treatment from insurance companies. We must spend just as long on hold as our patient does.

I’m at my best working for my patients in the operating room, not spending two hours on the phone trying not to lose my patience with an insurance company representative.

So, I will tell you this…my office can’t help you get insurance covered for your eyelid procedure but when you’re declined, call my office and we’ll walk you through how you can afford the procedure yourself.

Why Upper Eyelids Are Treated Differently Than Lower Eyelids

Upper eyelid surgery

Excess upper eyelid skin can physically block vision. Because this affects function, upper blepharoplasty is the procedure most often considered for insurance coverage when proper documentation is provided.

Lower eyelid surgery

Lower blepharoplasty usually addresses under-eye bags, puffiness, or cosmetic aging changes. These concerns rarely interfere with vision, so lower eyelid surgery is almost always classified as cosmetic and not covered.

How the Insurance Approval Process Allegedly Works

If your case looks functional, the insurance process, including Medicare, is supposed to go like this:

- Consultation with a surgeon’s office (often an eye doctor first)

- Medical evaluation and Documentation gathered: photos, notes, symptoms, medical history

- Visual field testing (often taped vs untaped comparison)

- Pre-authorization request submitted to the insurance company

- Insurance approval (or denial with next steps)

- Appeal if additional documentation is needed (it always is)

You will be denied. Everyone is always denied.

At this point, I suggest you appeal the denial but please remember that less than .01% of blepharoplasty procedures end up being paid by some form of insurance. Most likely, you’ll be denied again. You’ll know you did everything you could and that matters.

Once you’re ready, call my office and our financing expert will walk you through payment options including affordable monthly payments.

Out-of-Pocket Costs You May Still Have

Even when blepharoplasty is approved by insurance, patients are still responsible for a heavy list of out-of-pocket expenses:

- Deductibles

- Copays or coinsurance

- Facility fees

- Anesthesia fees

- Recovery expenses

- Costs related to cosmetic portions of the procedure which the insurance company can claim is 80+% of the cost of the procedure

If the surgery is cosmetic, the entire cost of the procedure is typically paid out of pocket.

What About Brow Lift or Ptosis Repair or Medical Necessity Combos?

This has happened before, a person thinks they need upper eyelid surgery, but the real problem is brow ptosis (drooping brow) pushing tissue down or a muscle-related eyelid problem.

Some policies treat these as distinct problems requiring distinct proof, sometimes even multiple photos showing different findings.

If a brow lift or ptosis surgery is part of the plan, documentation matters even more. Each procedure has its own insurance criteria and documentation requirements. As always, your coverage decisions depend on whether the condition creates functional problems.

And again, you’re trying to convince an insurance company to cover something that they’ll spend a year refusing to pay for so keep that in mind during the process.

Financing Options When Insurance Says No

If it’s cosmetic reasons and insurance carriers deny coverage options, you’re not defeated yet.

- Monthly payment plans that you can afford

- Medical financing programs with no to low interest rates

- Flexible payment options

- Phased treatment planning

- Personal bank loan if you have good credit

- These can make cosmetic eyelid surgery more accessible without relying on standard credit cards.

A Note for Patients in Hawaii and Honolulu

Patients in Honolulu, HI follow the same insurance rules as the mainland United States — coverage depends on medical necessity, documentation, and testing.

If you’re in Honolulu or anywhere in Hawaii, you’ll see the same insurance rules as the mainland: coverage depends on medical necessity, specific medical reasons, documentation, and visual field testing.

And unless you’re in that magic 0.01%, your upper eyelid lift will still be denied.

For patients considering care with a facial plastic surgeon in Honolulu, the smartest move is to schedule an initial consultation and ask directly:

- \“Do I look like a functional candidate?”

- “Will your office handle pre-authorization?”

- “What testing do you need from me?”

That one conversation can save you months. You’ll still be denied but you’ll have done all you can.

When you’re ready to make your own desires come true and give yourself that blepharoplasty that’ll put a smile on your face in selfies again, call my office and we’ll help walk you through affordable payment options.

FAQs People Actually Ask (and Insurers Quietly Care About)

Does insurance cover blepharoplasty for droopy eyelids?

Not very often. You’ll need to prove that your droopy eyelids create substantial functional problems and you’ll need plenty of documentation like visual field testing and photos.

Is lower blepharoplasty ever covered?

No. Lower eyelid surgery is considered cosmetic, even when under-eye bags are severe. Insurance companies don’t care if you like what you see in the mirror.

What counts as “medical necessity”?

A documented obstruction of the upper visual field that impacts your activities of daily living, and you will need objective proof. Policies often mention visual field loss and measurements like MRD1.

Will my insurance provider require visual field testing?

Yes. Some insurers specify taped and untaped testing within a certain time window.

Will my healthcare provider care if my excess eyelid skin is affecting my peripheral vision?

Not at all.

Do I need photographs?

Absolutely. Insurers give detailed photo requirements (eye level, pupil visibility, lid margin position).

Does insurance cover lower eyelid surgery for under-eye bags?

No because under-eye bags are typically cosmetic purposes.

Can a denied claim be appealed?

Yes. In fact, most claims are quickly denied. In the rare instance of an approval, it only occurs after additional documentation or clarification is submitted. Start by asking what was missing or was specifically denied in your original submission.

What should I bring to my consultation?

A list of symptoms, medical history, insurance information, and a clear explanation of how your eyelids affect daily life. Ask the doctor his or her honest opinion of your chances to receive medical insurance coverage on this procedure.

A Simple Checklist to Bring to Your Surgeon’s Office

If you want the smoothest insurance process, bring:

- A written list of how your eyelids affect daily life

- Any relevant medical records (dry eye, headaches, eye strain, etc.)

- Your insurance plan details

- Willingness to do photos and visual field testing if requested

Quick Disclaimer

This is general education, not professional medical advice. Your insurance policies and medical condition control what’s approved.

Insurance coverage for blepharoplasty isn’t about how you look; it’s about how your eyelids function. And you will be denied. You should appeal but you’ll likely be denied again. It doesn’t hurt to try, of course!

If excess upper eyelid skin interferes with your vision, work, or safety, coverage may be possible with the right documentation. If your goals are cosmetic, understanding the total cost of blepharoplasty as well as your financing options upfront helps you plan with confidence. Contact my office and we’ll discuss your options.